The day-to-day work of an Underwriter ranges from research, to data entry, to pricing a risk, to ultimately negotiating that premium value with an agent. At the core, they need to accurately gauge risk, on a case by case basis. But their job doesn’t stop there. Even if we were to codify all the significant risk factors (as actuarial tables do), this doesn’t translate directly to how much the insurance firm ultimately charges for a given premium. Underwriters need to create an offer that they can justify to their customers, and keep an eye on the prevailing market dynamics.

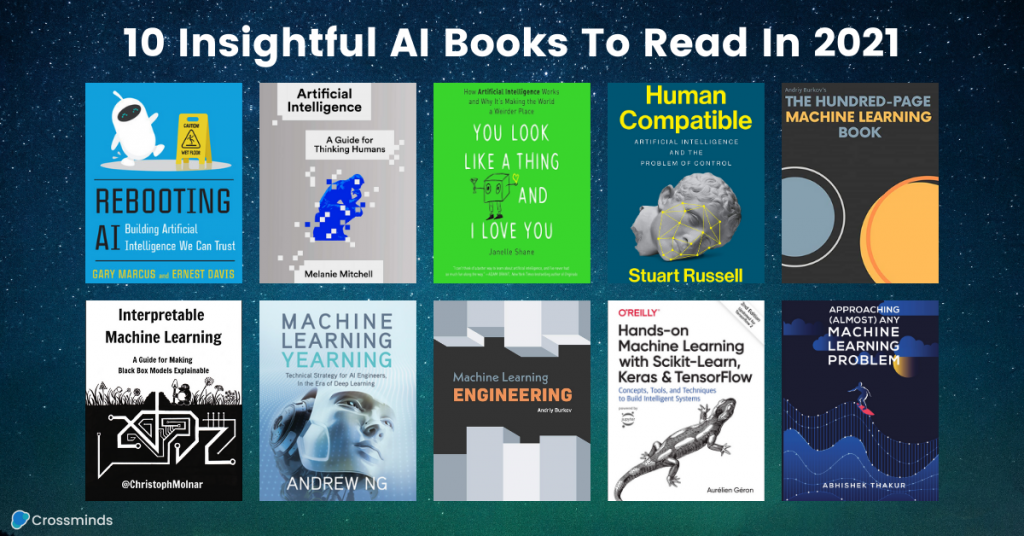

Underwriters navigate a sea of data, software, and file formats to reach a premium for each policy. It’s challenging work, with many uncertainties. In our experience, Machine Learning can be used to enhance the insurance underwriting process in a number of ways.

Continue Reading